Global Manufacturing Ecnomic Update

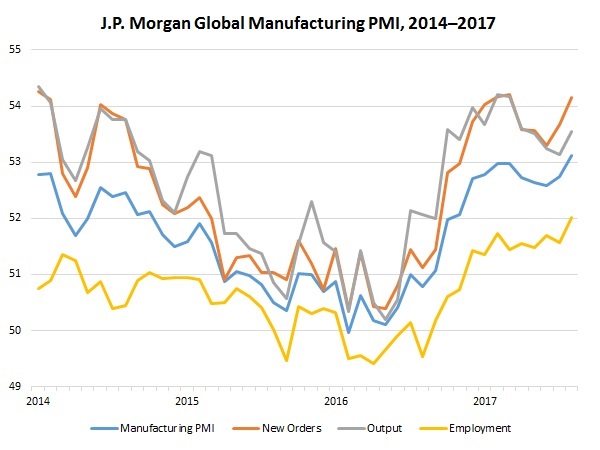

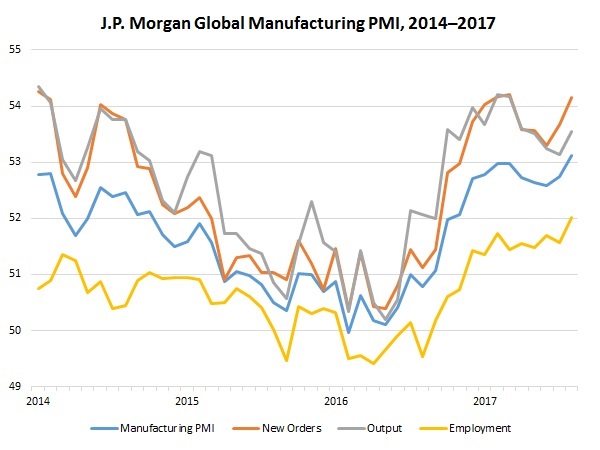

The J.P. Morgan Global Manufacturing PMI increased from 52.7 in July to 53.1 in August, its fastest pace since May 2011. The underlying data rose across the board, including new orders, output, exports and employment. The hiring data mirrored the headline index, with employment growth at a pace not seen since June 2011. Looking ahead six months, manufacturing leaders continued to be very upbeat in their outlook, with the index for future output unchanged at 63.5. Readings greater than 60 suggest robust growth for the next six months, illustrating the optimism for the second half of 2017. In August, just two of the top-15 markets for U.S.-manufactured goods contracted, similar to July. While none of those markets contracted in June, the vast majority of those nations have seen tremendous progress over the past year, which is encouraging. Moreover, the two markets that contracted in August—Hong Kong (down from 51.3 to 49.7) and South Korea (up from 49.1 to 49.9)—were just barely doing so.

Meanwhile, Europe continued to dominate the list of the top export markets with strong manufacturing growth. Those countries with the highest PMI readings in the sector in August included the Netherlands, Germany, the United Arab Emirates, the United Kingdom, France, Canada and Taiwan. Specific to the Eurozone, manufacturing activity grew at its highest rate since April 2011, illustrating just how much the continent’s economies have turned a corner over the past year. That progress was not limited to sentiment data either. Real GDP in the Eurozone increased 0.6 percent in the second quarter. That translated into 2.3 percent growth year-over-year, its quickest pace since the first quarter of 2011, and industrial production has risen 3.2 percent year-over-year, which represents a healthy increase in output since July 2016. At the same time, the unemployment rate in July remained at 9.1 percent, its lowest level since February 2009.

We have seen progress in other economies as well, including the emerging markets. The IHS Markit Emerging Markets Manufacturing Index rose to its best reading since January 2013. More importantly, the headline index has now expanded for 14 straight months, reflecting improvements in the emerging markets since this time last year. The country-by-country data were mixed, but a number of emerging markets made marked improvements in August, including China, Nigeria, Poland, Saudi Arabia, Taiwan, the United Arab Emirates and Vietnam. Economic sentiment in Nigeria was the highest since June 2015. Meanwhile, manufacturers in India reported positive growth in the latest report, bouncing back from July’s lowest reading since February 2009.

Better global economic growth has been one factor in helping to turn around exports, but the weaker U.S. dollar has also played a large role. In fact, the U.S. dollar has depreciated 10.2 percent year to date in 2017 against major currencies, even as it remained nearly 13.6 percent higher than it was three years ago. As a result, exports have trended in the right direction through the first seven months of this year—a welcome development after weaker data during the past two years. Using non-seasonally adjusted data, U.S.-manufactured goods exports have increased 3.9 percent year to date relative to the same time period last year.

The NAM continues its work to obtain positive results from efforts to update and modernize the North American Free Trade Agreement (NAFTA), which will enter the third round of negotiations later this month in Ottawa. Discussions also continue between the United States and South Korea on a potential renegotiation of the Korea–U.S. (KORUS) Free Trade Agreement (FTA). The United States launched a Section 301 investigation into Chinese policies on technology transfer and intellectual property. The NAM continued its work to ramp up opposition to Scott Garrett as president and chair of the Export-Import (Ex-Im) Bank. U.S. Customs and Border Protection (CBP) also concluded its first evasion investigation, using the new procedures that the NAM had successfully worked to include in the Trade Facilitation and Trade Enforcement Act.

Chad Moutray, Ph.D., CBE

Chief Economist

National Associa tion of Manufacturers of USA